Calling Higher Ed Scholars: Here’s How to Comment on the Student Loan Provisions of the New ‘One Big Beautiful Bill Act’ Rules

To read the proposed regulations this post discusses or to submit comments to the Department of Education, click here.

The Department recently released proposed regulations that clarify key implementation details of the One Big Beautiful Bill Act’s (OBBBA) provisions related to loan repayment and new graduate and parent loan limits, with proposed rules on Pell Grant eligibility for short-term programs and for accountability of higher education programs expected to follow in the next several months. Comments on the first proposed rule are due on March 2, 2026. Comments are critically important to the policy process: The law requires that any changes to the proposed rule at this stage must be tied to public comments, and the Department of Education must defend why any substantive proposals introduced in public comments are not adopted. Higher education researchers can play a critical role by submitting their own comments reacting to the proposed rule. This post provides an overview of the Department of Education’s current rulemaking, highlighting several areas where we believe researchers might most usefully provide comment.

Student and Parent Loan Limits

Provisions in the Law

Among the most significant changes in the OBBBA are reductions in loan limits (the maximum dollar amounts that students can borrow) for part-time students, parent borrowers, and graduate students. The new limits will substantially impact the student loan landscape, and lead many more parents and students to seek loans from the private market. We’ll take each of the major changes in turn.

Whereas part-time students have long had their Pell Grants prorated based on their attendance intensity, they have always maintained access to loans—with no difference in borrowing limits—as if they were full-time students. The OBBBA will instead prorate their loan eligibility based on their enrollment status (both for undergraduate and graduate students) – and, unlike with the other loan limit changes in the law, that change happens immediately starting July 1 this year, even for current borrowers already enrolled in a program, with no phase-in period.

Meanwhile, the parents of dependent undergraduate students who borrow Parent PLUS loans will be limited to $20,000 per year ($65,000 in aggregate), rather than being able to borrow all the way up to the student’s cost of attendance. While the change may help limit unaffordable borrowing by some, the new limits are apt to create confusion for many and lead some parent borrowers to the private market – with particular challenges for parents who borrow the maximum each year and wind up hitting their aggregate limit early in their child’s fourth year of school. PEER Center estimates suggest that about 29 percent of parent borrowers currently take out amounts above those annual limits, on average exceeding the annual cap by more than $10,000.

Graduate students will be especially affected by new loan limits under the law. While graduate students can currently borrow up to $20,500 per year in unsubsidized loans, and up to their full costs of attendance in Grad PLUS loans, the OBBBA eliminates Grad PLUS altogether and keeps the annual limit at $20,500 for most graduate programs, with a higher, $50,000 limit per year for professional programs. (Aggregate limits are set at $100,000 and $200,000, respectively.) The PEER Center found that more than one in four graduate or professional borrowers took out more than these new annual limits, particularly among professional programs like medicine and dentistry, on average exceeding the new caps by about $22,000 per year, and even more when accounting for the further reduction in loan eligibility that will be applied to part-time graduate students. A report authored by the PEER Center's Jordan Matsudaira and researchers at the Federal Reserve Bank of Philadelphia further found that nearly 40 percent of those affected borrowers have credit scores too low or too thin to access private loans without a qualified cosigner.

Beyond these new federal loan limits for part-time students, undergraduate students’ parents, and graduate students, another set of loan limits could apply: institutionally determined loan limits. Colleges’ financial aid administrators are granted authority by OBBBA to lower the loan eligibility of all students (or their parents) in a given program of study, as long as they apply the same limit to all students enrolled in the program. The idea was once the subject of an Education Department pilot project, though the pilot produced little evidence of its impact.

Policy Details Left to the Department’s Discretion to Regulate

The new loan limits for parents, graduate students, and part-time students are set by the law, and are unlikely to be changed through regulations. But there are several key implementation questions that will be determined by the Department, through the ongoing rulemaking process. Commenters can help to inform these aspects of how the new policies are implemented.

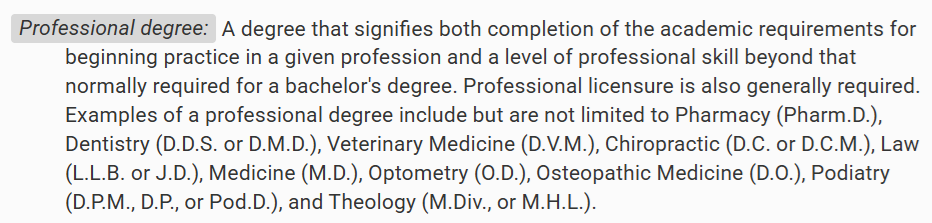

Definition of a Professional Degree: The biggest question in the Department’s proposed regulations that affects the impact of the new loan limits is the definition of a professional program. The OBBBA required that the higher, $50,000-a-year graduate-loan limits apply to students in professional degree programs, and cited an existing regulation defining such programs (see Figure 1). But that regulation doesn’t provide much clarity, offering only a few clues. First, professional programs must meet the requirements for “beginning practice in a given profession,” beyond the skills “normally” required for a bachelor’s degree. Second, professional degrees “generally” lead to licensure in the field. And finally, the regulations offer a nonexhaustive list of example programs. Some of those examples are expected (like M.D. and osteopathic medicine programs, dentistry, veterinary medicine, and law), while others are unexpected – master’s of divinity degrees in theology, for example.

FIGURE 1: Existing Regulatory Definition of Professional Degrees

Source: 34 CFR 668.2

The Department’s approach in its proposed regulation doesn’t offer much more clarity. It added to the list of 10 fields in the rule (see Figure 1) a number of psychology and pharmacy fields, but didn’t go much beyond that, saying that professional degrees are (generally) doctoral degrees that (generally) require professional licensure and that are in the same 10 fields in the existing definition, plus clinical psychology (Psy.D. or Ph.D.), or that are in an adjacent field (i.e., one in the same four-digit Classification of Instructional Programs (CIP) code as any of those 11 named fields). (Stakeholders representing “taxpayers and the public interest” proposed a similar, but more expansive version, of this approach during the rulemaking process.)

As word got around about the planned definition earlier this year, it caused a ruckus on social media – particularly about the exclusion of healthcare fields like physician assistants, nurse practitioners, and physical and occupational therapists (all of which could have fallen under the original version proposed by negotiators, if they required at least 80 credit hours for completion). Since then, several members of Congress have proposed legislation extending the professional-degree designation to a range of programs in fields like healthcare, social work, and education.

There can be little doubt that this provision will be one of the most contentious (and litigated) provisions in the regulation – meaning the input of scholars and a strong evidence base will be especially relevant. Comments that can define specific criteria for deeming programs “professional” that include the programs referenced in the regulatory cite referenced by OBBBA, and clearly articulate why other programs are at least as consistent with the (admittedly vague) criteria referenced in Figure 1—related to training for professional practice, skill level, and licensure requirements—as the enumerated programs are, could help the Department establish a rational basis for defining programs eligible for the higher loan limit. Proposed 34 CFR § 685.102(b), Definition of a Professional Student

Transition Period for Part-Time Students: The law explicitly provides for a phase-in period of the new loan limits for current parent and graduate student borrowers, allowing people who have already borrowed for the programs to finish out the program (or for three academic years, whichever is shorter). But for part-time students, no such provision was explicit in OBBBA – and the Education Department declined to add a transition period in its draft regulations, citing a lack of statutory basis. We believe ED could choose to add a transition period to mitigate the disruptions caused by an abrupt change in rules.

To help inform the Department’s final regulations, commenters could highlight research on the impact that a lack of transition period might have on student outcomes, or how (absent a transition period) the Department might mitigate adverse impacts by requiring institutions to provide students with information or other assistance. For example, scholars might assess how many part-time borrowers are likely to be affected in the upcoming award year(s) and/or the potential impact of sudden restrictions on federal credit on borrowers’ outcomes (e.g., completion). If the Department opts against a transition period, commenters could suggest the Department require counseling for students, including by highlighting research on effective communication with borrowers and other vulnerable populations, or financial literacy approaches that schools could use to help their part-time students adjust their budgets and cover their financial gaps. Proposed 34 CFR 685.203(m)(1)

Application of Institutionally Determined Loan Limits: The new authority for institutions to apply their own, lower loan limits to particular programs of study comes without much direction for how institutions could or should consider using that authority, except that they must apply the limits uniformly within a program.

Scholars could suggest that the Department of Education require colleges to report on how they use this new authority, including for which programs they apply the lower limits and the rationale – like considering the earnings of programs in setting reduced loan limits – they use for those institutional limits. Researchers can provide suggestions about the type of information the Department itself should collect to help inform and guide future research. Providing evidence about how institutions should inform students about the limits, incorporate them into advising and counseling sessions with students, and post information online will also help improve what the Department may require of schools. Proposed 34 CFR 685.203(m)(2)

Student Loan Repayment

Provisions in the Law

OBBBA laid out a new set of student loan repayment plans. New borrowers (those taking out loans on or after July 1, 2026) will have access to only two repayment options: a “tiered standard” plan that sets fixed payments over a 10- to 25-year repayment term, depending on how much debt they have; and a Repayment Assistance Plan (RAP) that sets payments based on borrowers’ adjusted gross incomes – 1 percent of AGI for incomes of $10,000-$20,000, 2 percent for incomes of $20-30,000, and so on, up to 10 percent of AGI. Unlike previous income-driven plans, RAP has no zero-dollar payment option; borrowers are required to pay a minimum of $10 every month.

Borrowers on RAP will need to repay until their loans are gone or for 30 years, whichever comes first; many will get interest and principal subsidies each month to help them make progress toward paying their loans down. The borrower will need to make an on-time monthly payment before the due date to qualify for those subsidies. The terms of these plans are circumscribed in the law, meaning the Department can’t change them through the regulations (even in response to comments).

Also required by the law, current borrowers on other income-driven repayment (IDR) plans like Pay As You Earn (PAYE) and Saving on a Valuable Education (SAVE) will need to move to the “Income-Based Repayment” plans over the next few years, as their existing plans are phased out. Phasing out soon, too, are deferments on monthly payments for borrowers experiencing economic hardship or unemployment. Borrowers may be able to get an interest-bearing forbearance on their loans, but not for more than 9 months within a 24-month period. Borrowers in default on their loans will have two opportunities to rehabilitate their loans (rather than the current one-time opportunity), making minimum payments of $10 (not the current $5) for those with Direct Loans.

Policy Details Left to the Department’s Discretion to Regulate

As noted above, the terms and conditions for the new repayment plans are laid out in the OBBBA, so can’t be changed via the regulations. But below, we’ve highlighted some of the key areas that are within the Department’s discretion to determine through these regulations, where public comments with evidence- and research-based suggestions could have a significant impact.

FUTURE Act and Other Provisions in the SAVE Regulations: There is an added complicating factor for these loan repayment regulations: After the Department began the rulemaking process, the Education Department announced a settlement in litigation against the Biden-era SAVE repayment plan. Under the new settlement, ED now has to run another rulemaking to take SAVE off the books. That forthcoming rulemaking process to rescind SAVE leaves in limbo some important changes that were made by the SAVE regulations, but that were not related to the repayment plan itself. Namely, that includes how and when borrowers’ information can be shared between the IRS and ED to facilitate enrollment and re-enrollment on any IDR plan (including RAP), how delinquent borrowers can be automatically enrolled in an IDR plan, and how current borrowers can earn credit toward Income-Based Repayment forgiveness while they’re in default on their loans. We don’t yet know when that rulemaking will start, or whether the Department will leave those provisions intact through those rules, but commenters concerned about preserving these changes from the SAVE rule, and taking additional steps to automate the repayment system, may want to address them here, too, given their implications for the new repayment system.

Comments on these provisions could cite research on the advantages of simplification or reducing barriers to application and participation in student aid programs; the challenges of annual recertification in IDR and the benefits of automatically recertifying borrowers’ incomes; and effective strategies (including enrollment in more affordable IDR plans) that help borrowers, especially those who are behind on their payments, avoid defaulting on their loans. 34 CFR 685.209(l), 34 CFR 685.209(m), 34 CFR 685.209(d)(2), and 34 CFR 685.209(k)(5)Easing Repayments for Borrowers in Default: Borrowers in default get shunted out of the Department of Education’s usual repayment system and into a separate system governed by tax refund offsets, wage garnishment, and other costly penalties. For many borrowers struggling financially, clawing back out of default is no small feat. That’s why some negotiators sought language that would better connect the two systems: ensuring defaulted borrowers rehabilitate their loans using a payment amount that matches the amount they’ll owe on another plan once they’re out of default, for instance, and strengthening the ability for defaulted borrowers to be automatically placed into an income-driven repayment plan after returning to good standing, as long as they’ve previously given consent to share their IRS income information. Though the Department opted not to include that language in the proposed rules, the public comments provide another opportunity to suggest improvements in student loan repayment for those in default.

Relatively little is known about the experiences of borrowers in default, so research on borrowers’ pathways into and out of default would be informative. In particular, it would be instructive to understand the rates of re-default for borrowers who have consistent and affordable monthly payments as they exit default, compared with the re-default rates for borrowers who instead see their monthly payments jump from their rehabilitation payments to their new, regular monthly payment amount. Proposed 34 CFR § 685.209 and Proposed 34 CFR § 685.211

Regulatory Impact Analysis

The Department’s regulations include a regulatory impact analysis (RIA), which highlights the costs and benefits of the proposed rules, and estimates their budgetary impacts. For this rule, the Department suggests that the largest costs (both for colleges and for borrowers) will be the adoption of new graduate and parent loan limits, but that those same limits may provide a significant benefit to students if colleges respond by limiting tuition increases. Commenters should review the RIA, both for its summary of the goals and provisions of the proposed rules, and to suggest additional refinements to the Department’s accounting of the costs and benefits of the proposed rules to make them more accurate. For instance, the Department’s assessment of the impacts of new graduate student loan limits refers to the benefits as colleges reduce their tuition increases, but does not cite evidence suggesting colleges will do so. Nor does it cite evidence related to the costs of foregone graduate education if some students are unable to cover their costs with federal or private student loans and are pushed out of graduate school altogether. Commenters can provide additional evidence to alter or adjust the assumptions built into the RIA and its budget estimates, or to highlight costs or benefits that are not discussed in the rule’s impact analysis at all.

How to Submit a Comment

Too often, research is under- or mis-used throughout the rulemaking process – but evidence and data are among the most valuable comments in impacting the process. The Department of Education is required to address any substantive comments received during the process, and research and analysis are particularly important in ensuring the Department’s approach is reasonable, appropriate, and sufficiently justified. To impact the process, comments need to be related to the proposed regulations, within the scope of the Department’s legislated authority (including both the One Big Beautiful Bill Act and the Higher Education Act more broadly), and should be backed by a strong rationale and clearly explained.

Commenters can submit their research, evidence, or proposals to the Education Department here. For more on submitting a comment, check out our tips for writing effective public comments, shared in a recent virtual event. And keep us in mind – the PEER Center is always available to consult with researchers and scholars about your comments! Reach us at peer-center@american.edu.